Works25 Accounting System

- Built for medium and big businesses, simplified for small and micro businesses.

- A part of an all-in-one business management software.

FREE TRIAL

for a month.

Complete accounting system at only RM2/day.

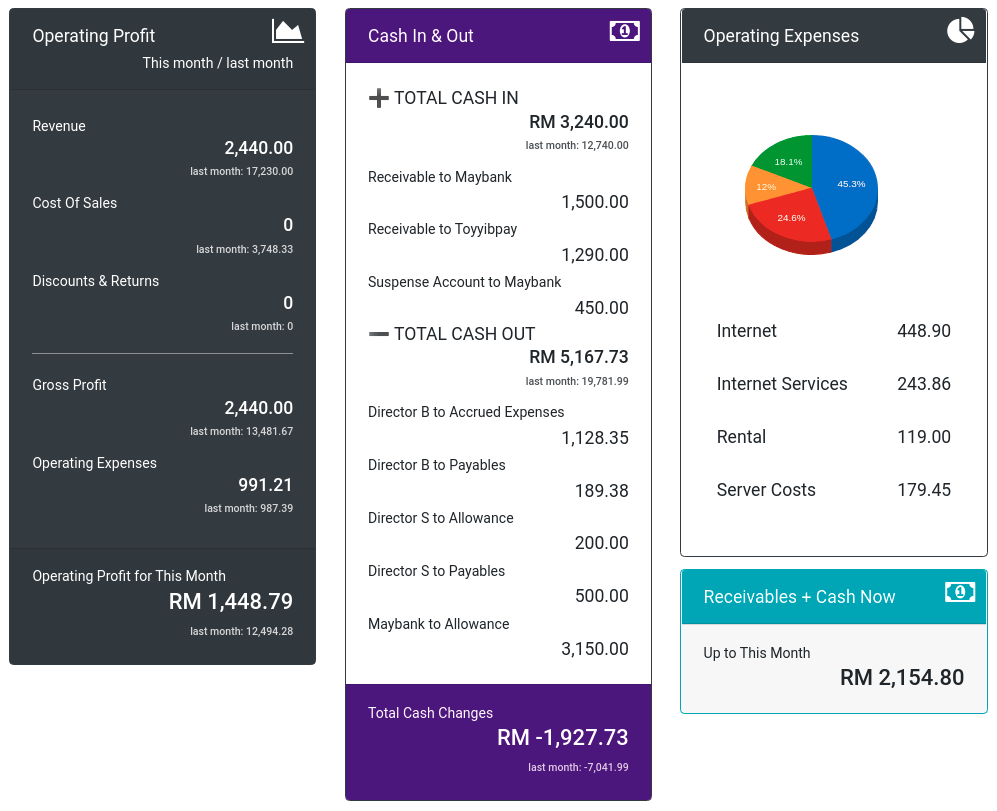

Financial health at a glance..

Summary

Gauge business financial health at a glance.

- Easily see comparison of this month Operating Profit, to last month’s.

- Check total cash balance, and all the cash-in and cash-out streams.

- See values and details of Operating Expenses of the month.

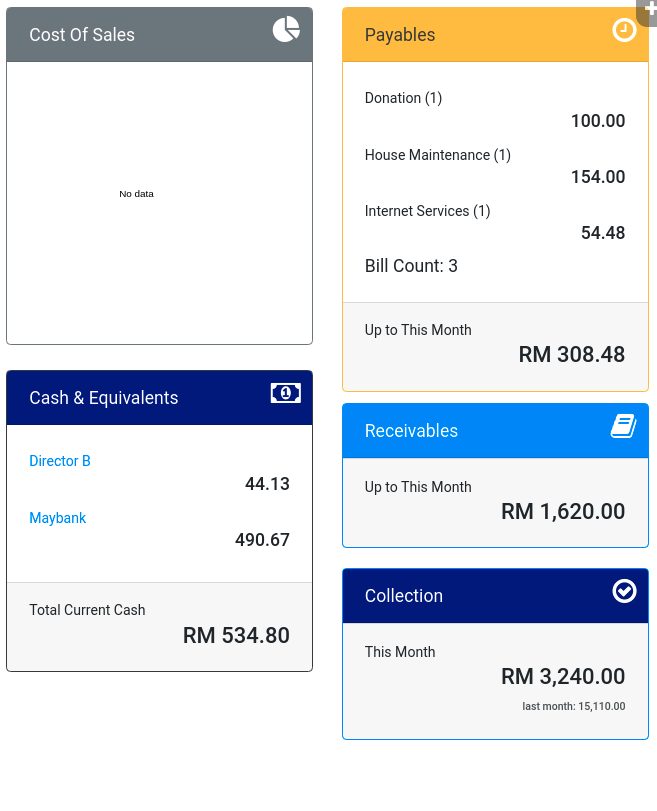

- See values and details of Cost Of Sales of the month.

- See current Cash values.

- See Payables bills up to the month.

- See and compare Collection and Receivables.

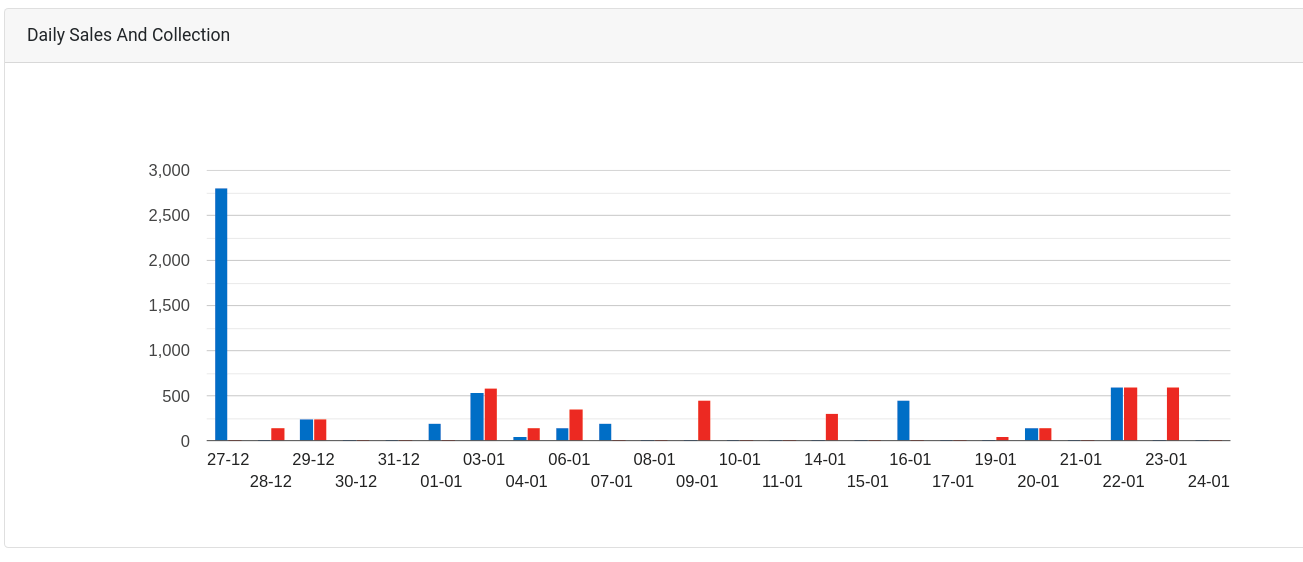

- Daily Sales and Collection Bar Chart.

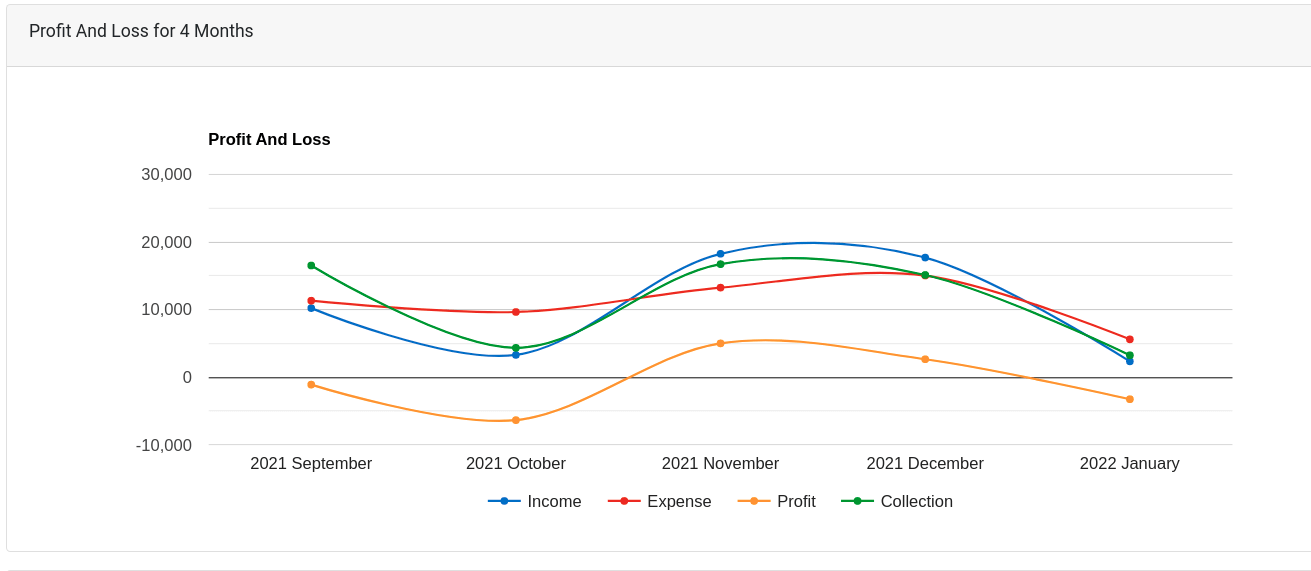

- Simple Profit and Loss graph with Collection.

- Cash changes graph.

- Sales by Category

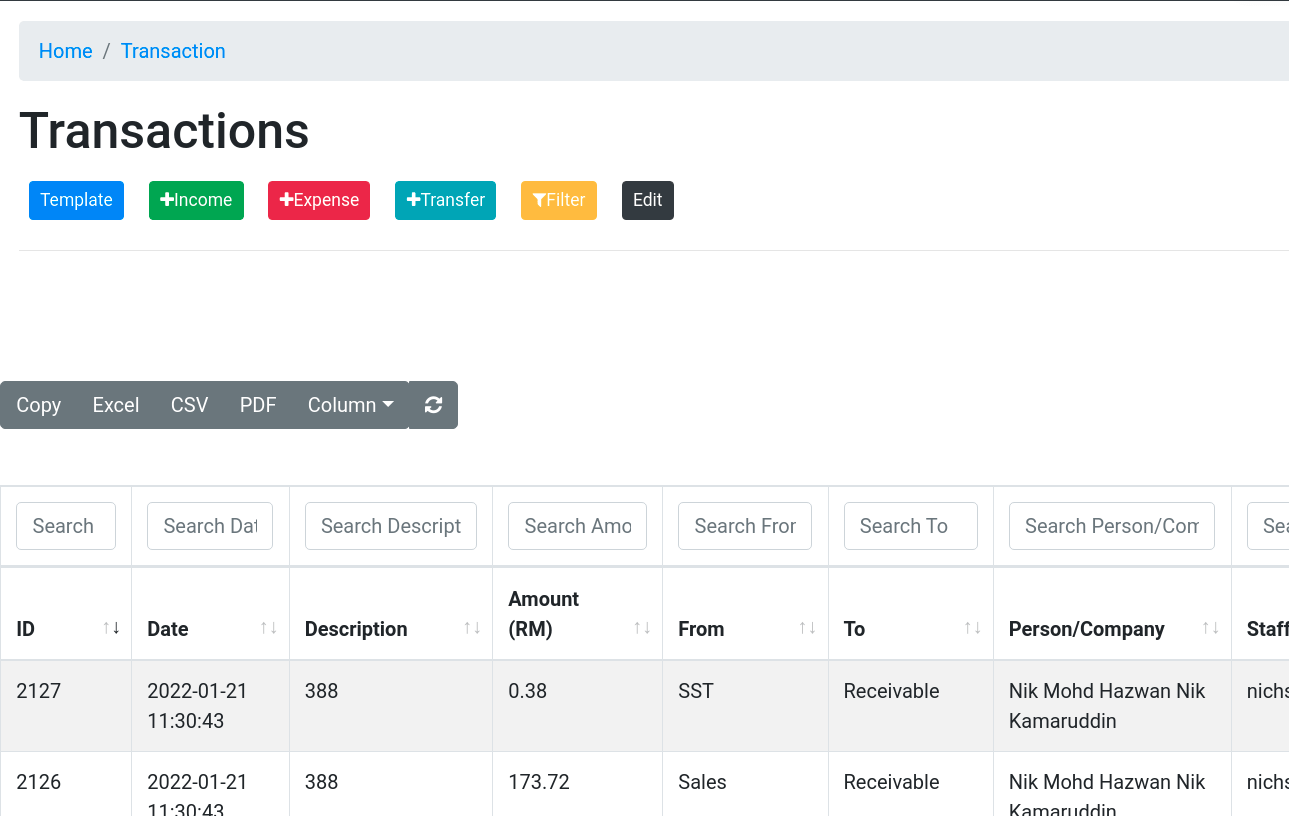

Centralized Transactions..

Journal

Each transaction of value in the business, is recorded in the accounting journal as a transaction consisting of:

- Date and Time

- From Account

- To Account

- Amount

- Person / Company ID

- Description

- Reference

- User

- Associated Link and Uploaded File

Filter, Sort by any or combination of columns. This journal is the heart of our Accounting Module. All financial reports and documents are extracted from this journal.

Several buttons are available for direct journal entry, with one for transactions template. By using saved template, repetitive journal entry would be much faster with fewer clicks.

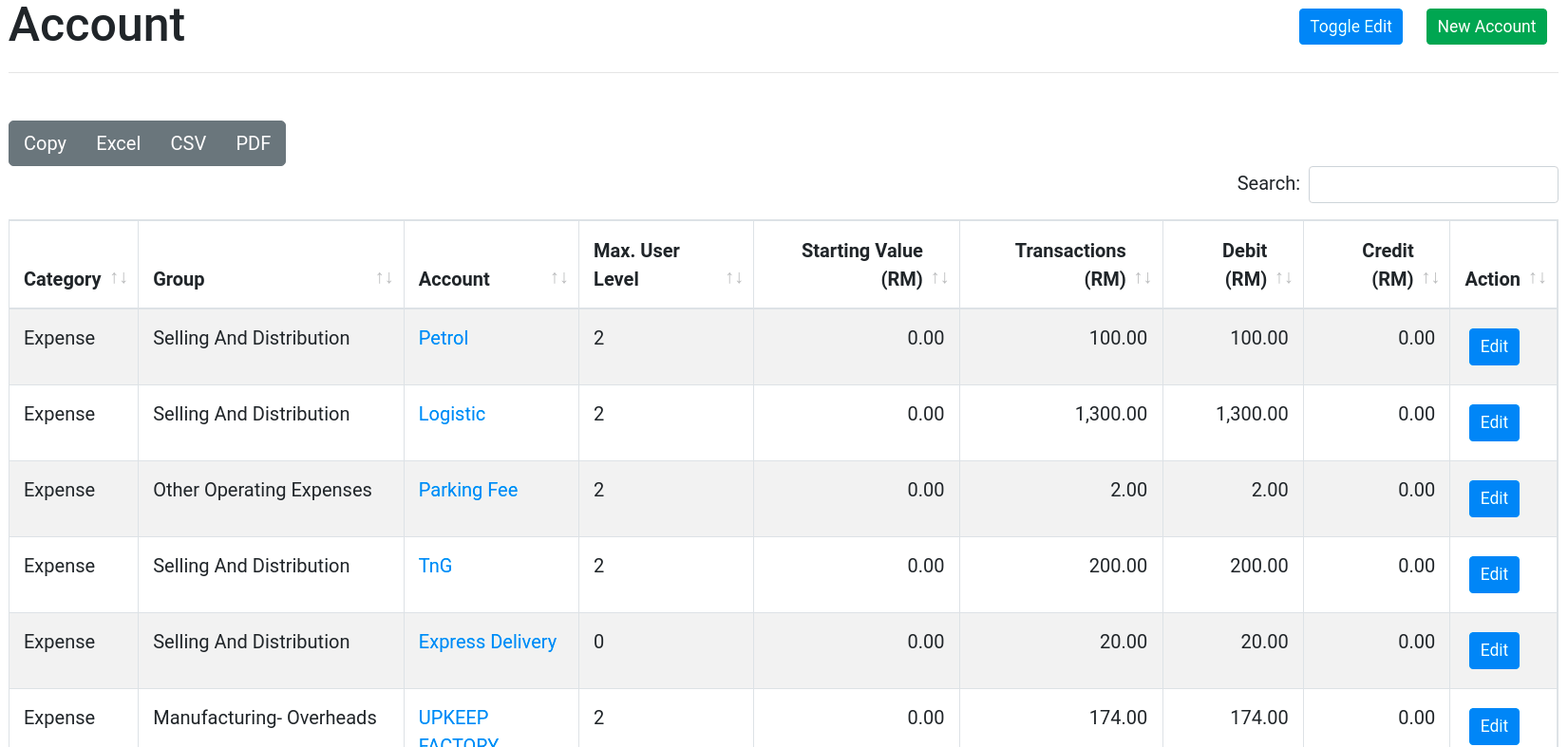

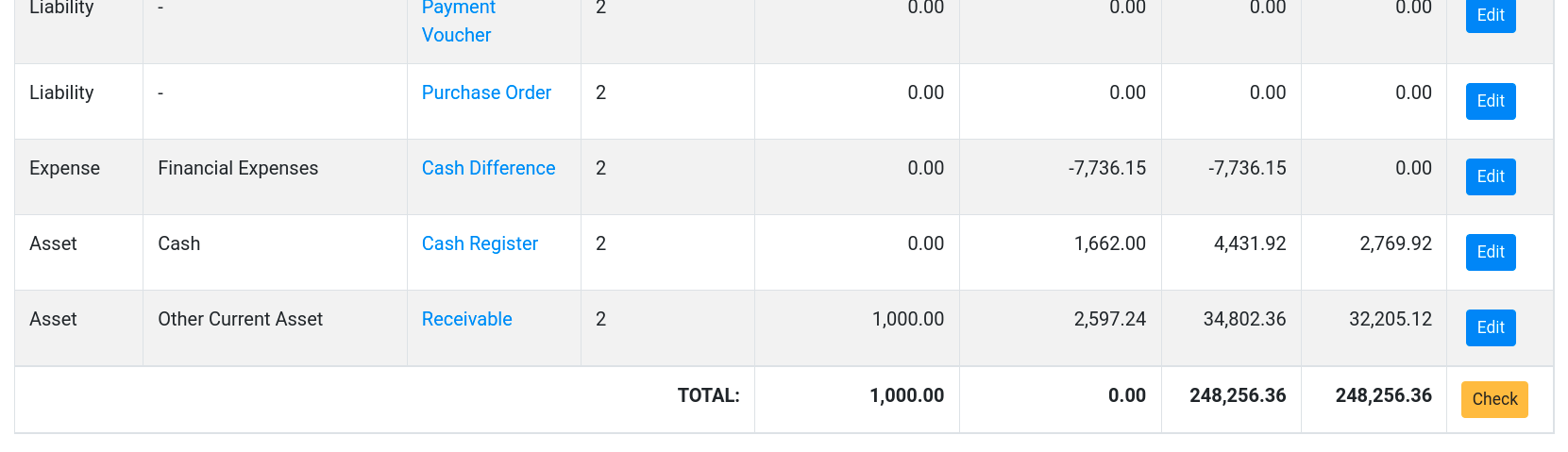

Automated Error Checks..

Chart Of Account and Trial Balance

Each account should be categorized into either Asset, Liability, Income, Expense or Equity, along with sub group of each category. The definition of each account is shown and can be edited from the Chart Of Account.

In the same page, the system always calculate for trial balance. So, user would know if there is a balance error, before viewing the Profit and Loss Statement.

If there is a balance error, the system will check and mention any incomplete transaction, or unregistered account. This saves a lot of time!

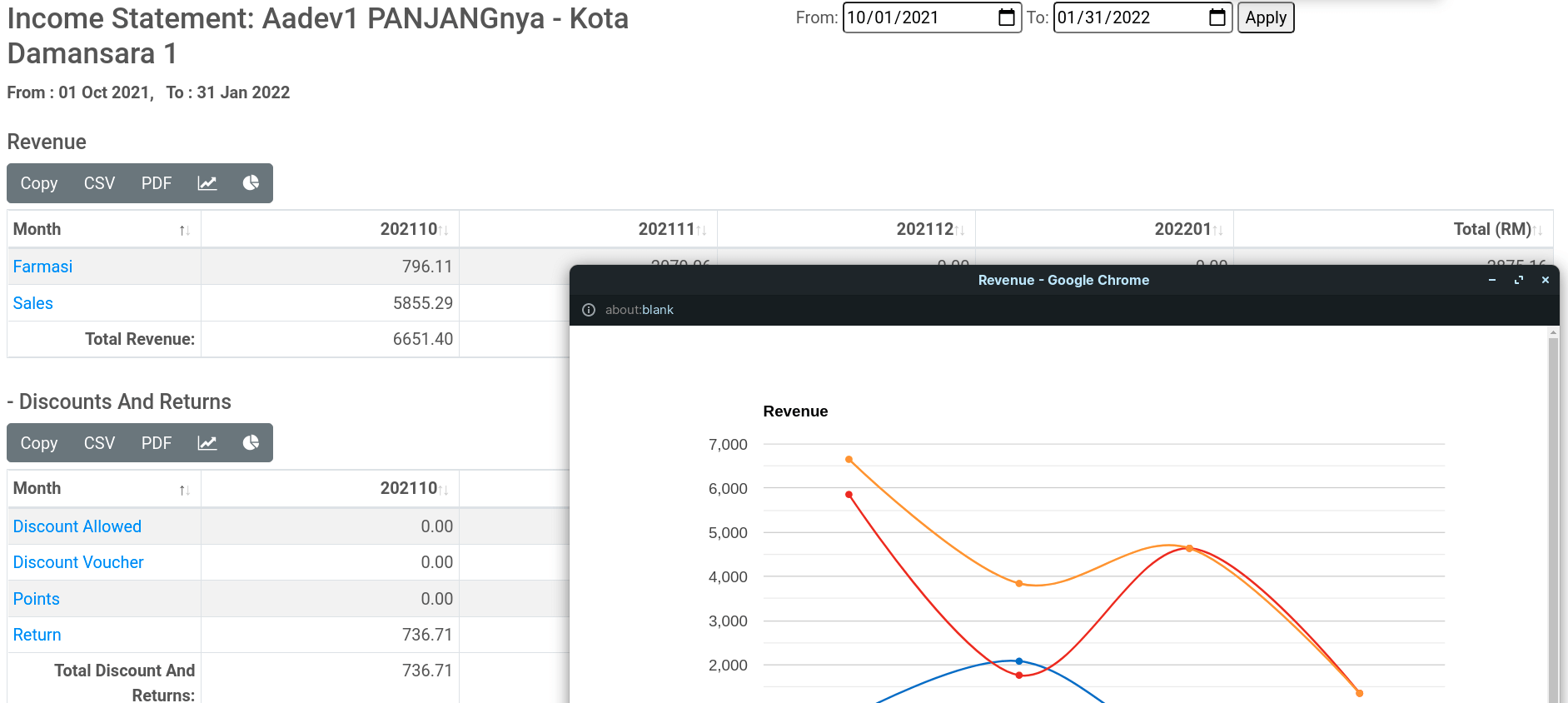

Analytical Reports..

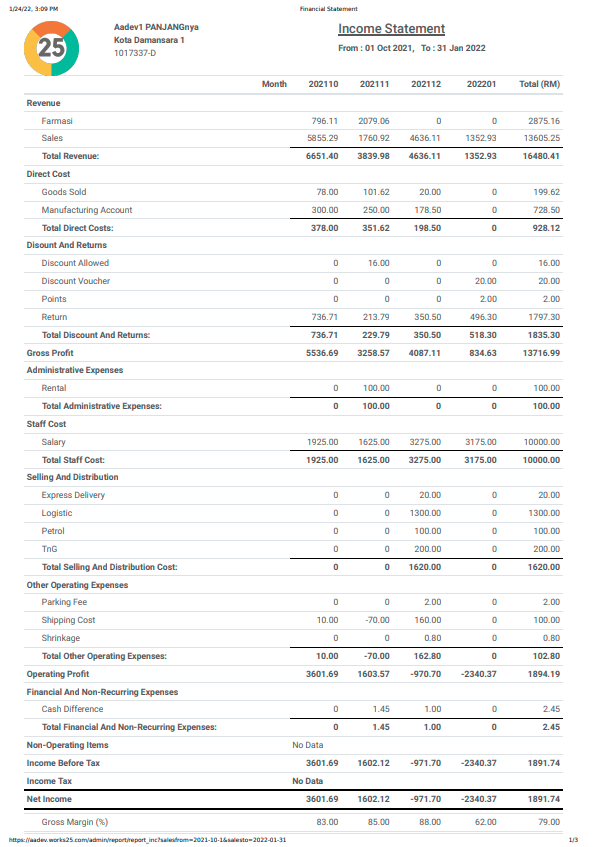

Income Statement (or PnL)

By default, the system will show a 3 month Income Statement, presented by months and total. The date period can be changed onto user’s choice on the given form.

If the chosen time period is more than 18 months, the system will present the Income Stament in terms of years instead of months.

There are 2 formats available:

- The standard Income Statement format,

- Analysis format.

The analysis format enable graphical comparison of selected account or group of accounts, between months (line chart), or by total (pie chart). This is especially useful to see changes more clearly.

In this format, user can also see statement of each account by clicking on the account name.

The Income and Expenses accounts are categorized onto:

- Revenue

- Discount and Returns

- Direct Cost and Manufacturing Account

- Administrative Expenses

- Staff Cost

- Selling And Distribution

- Other Operating Expenses

- Financial And Non-Recurring Expenses

- Non-Operating Items

- Income Tax

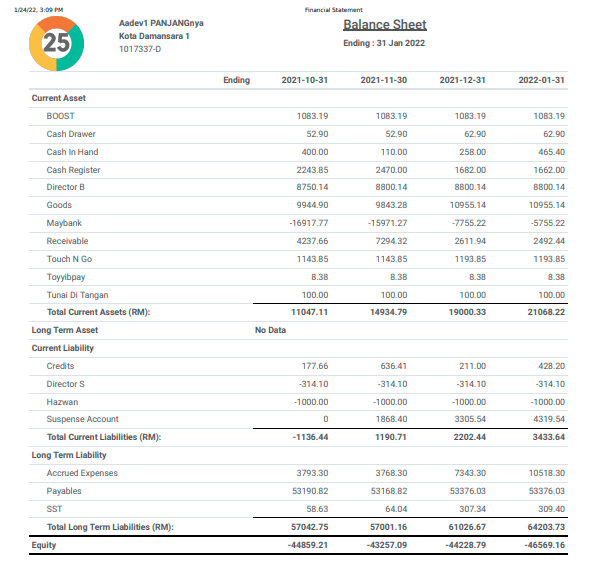

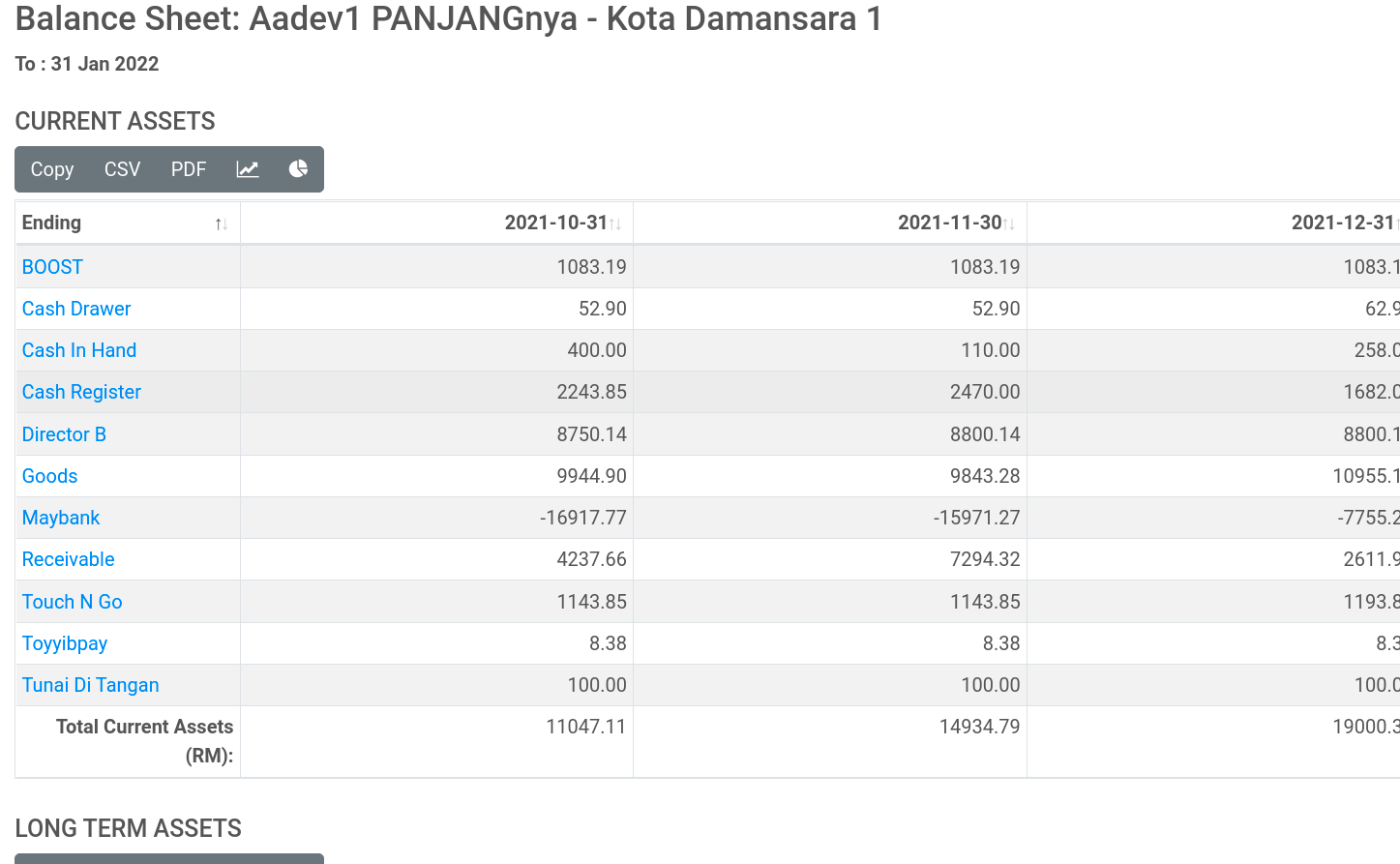

Balance Sheet

By default, the system will show a 3 month Balance Sheet, presented by months and total. The date period can be changed onto user’s choice on the given form.

If the chosen time period is more than 18 months, the system will present the Income Stament in terms of years instead of months.

There are 2 formats available:

- The standard Income Statement format,

- Analysis format.

The analysis format enable graphical comparison of selected account or group of accounts, between months (line chart), or by total (pie chart). This is especially useful to see changes more clearly.

In this format, user can also see statement of each account by clicking on the account name.

The Assets, Liability and Equity accounts are categorized onto:

- Current Assets

- Long Term Assets

- Current Liabilities

- Long Term Liabilities

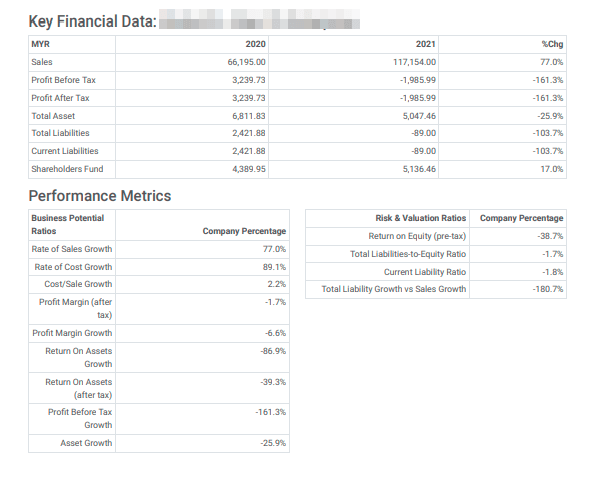

Key Financial Data & Performance Metrics

In Income Statement or Balance Sheet, if the date period chosen is more than 2 years, another section will appear, that is Key Financial Data. The system will compare data form these 2 years or more, and present a summary consisting of:

- Key Financial Data

- Sales

- Profit Before Tax

- Profit After Tax

- Total Assets

- Total Liabilities

- Current Liabilities

- Shareholder’s Fund

- Performance Metrics

- Business Potential Ratios

- Rate of Sales Growth

- Rate of Cost Growth

- Profit Margin

- Profit Margin Growth

- Return on Assets

- Profit Before Tax Growth

- Asset Growth

- Risk and Valuation Ratios

- Return on Equity

- Total Liabilities-To-Equity Ratio

- Current Liability Ratio

- Total Liability Growth vs Sales Growth

- Business Potential Ratios

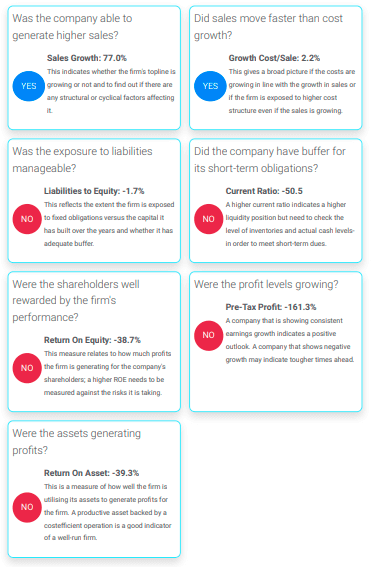

- Financial Profile

The system will answer 7 questions:- Was the company able to generate higher sales?

- Did sales move faster than cost growth?

- Was the exposure to liabilities manageable?

- Did the company have buffer for its short-term obligations?

- Were the shareholders well rewarded by the firm’s performance?

- Were the profit levels growing?

- Were the assets generating profits?

Easy Expense Entry..

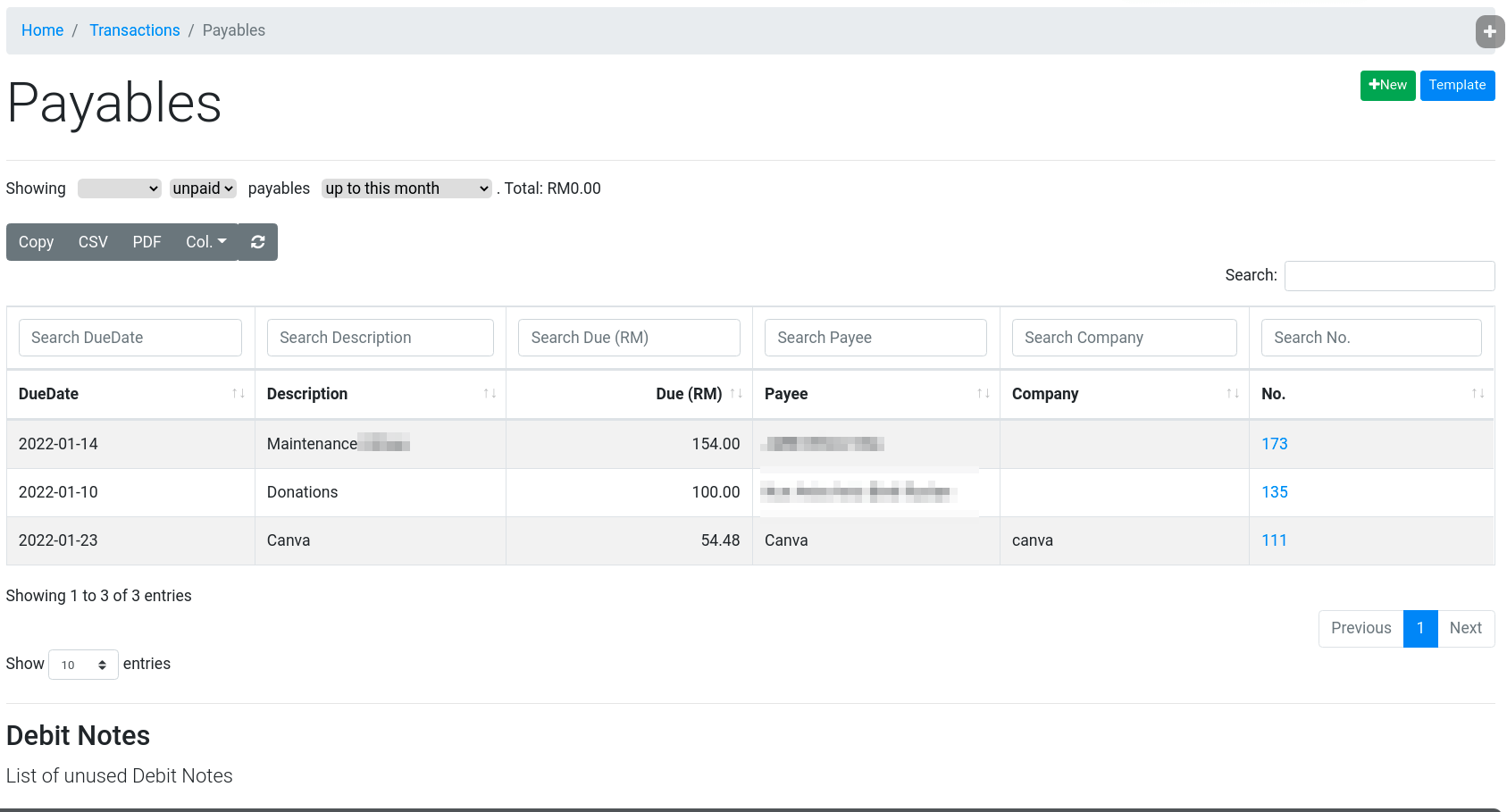

Payables

Expenses can be recorded directly onto the Journal, or in Payables. In payables, expenses are recorded, but not yet paid. This can be either Payables, or Accrued Expenses. Recording an expense into Payables open up many more options such as multiple accounts in single transactions, and recurring transactions.

The Payables page is a list of payables and accrued expenses. User can create new payable using the +New button or by using saved template.

There is also a list of unused debit notes at the bottom of the page.

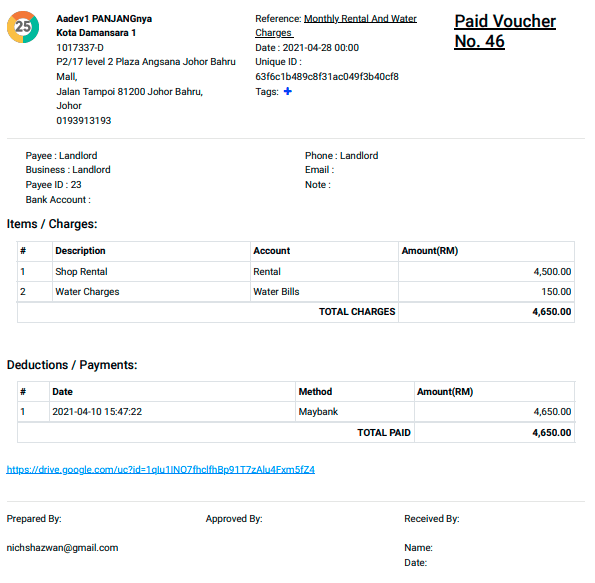

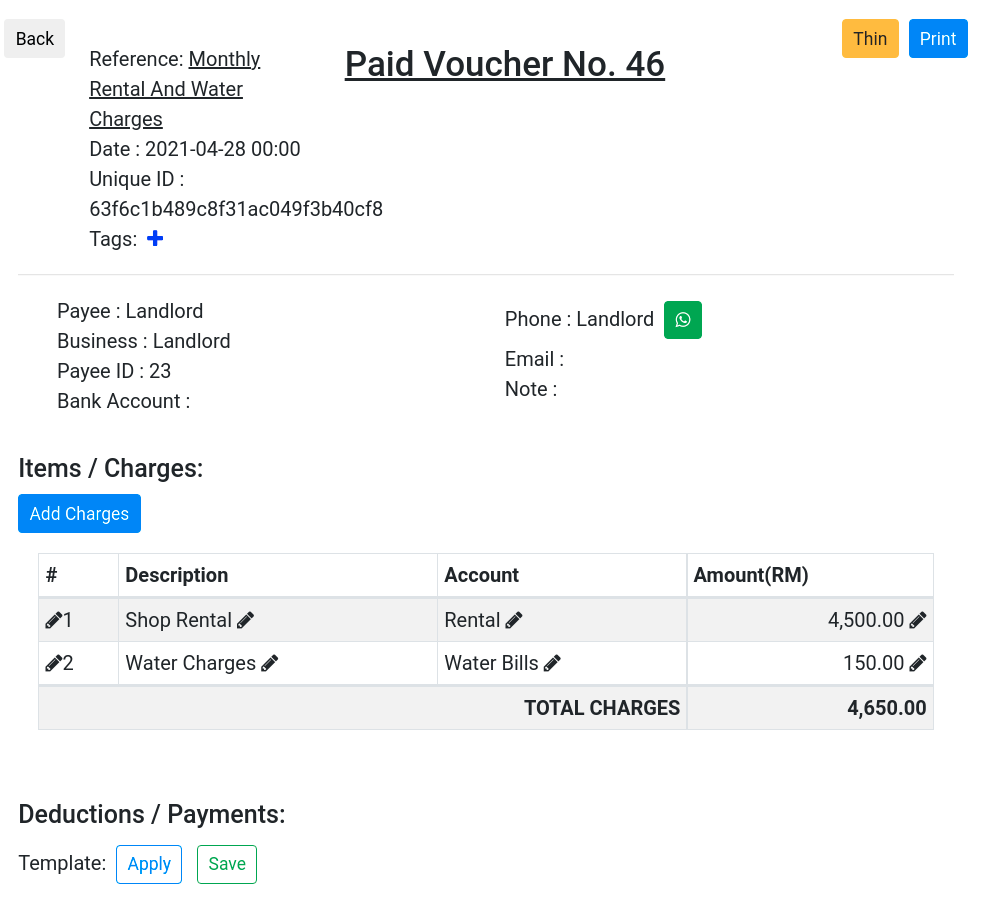

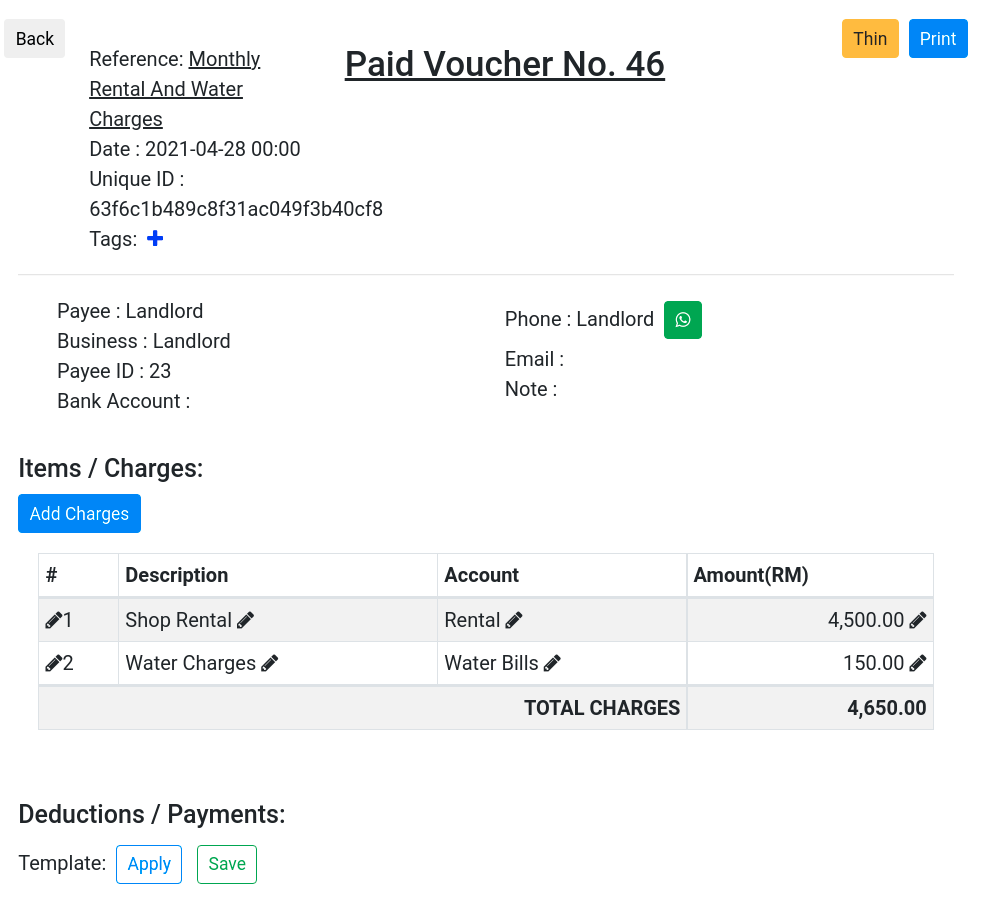

Payment Voucher

Each recorded payable will appear as a payment voucher with a running number. An authorized user can approve a payment voucher, then only can payment be recorded to change the status into Paid Voucher. Recording a payment or a deduction is as easy as clicking the Record Payment button, and choosing the payment method used.

If the payee has any debit note unused, a debit note button will appear to use the debit note against this PV.

Who prepared, and who approved the voucher, are displayed at the bottom of the PV.

In the Items/Charges section, user can add more transaction as charges. If the PV is generated through inventory items bought, the list of items value will appear in this section.

Any payment made towards this PV is displayed in the Deductions/Payments section. There is also a template payment button for complex or multiple payment accounts.

To inform the payee regarding status of payment, user can click on the whatsapp button or the email button.

No Transaction Missed..

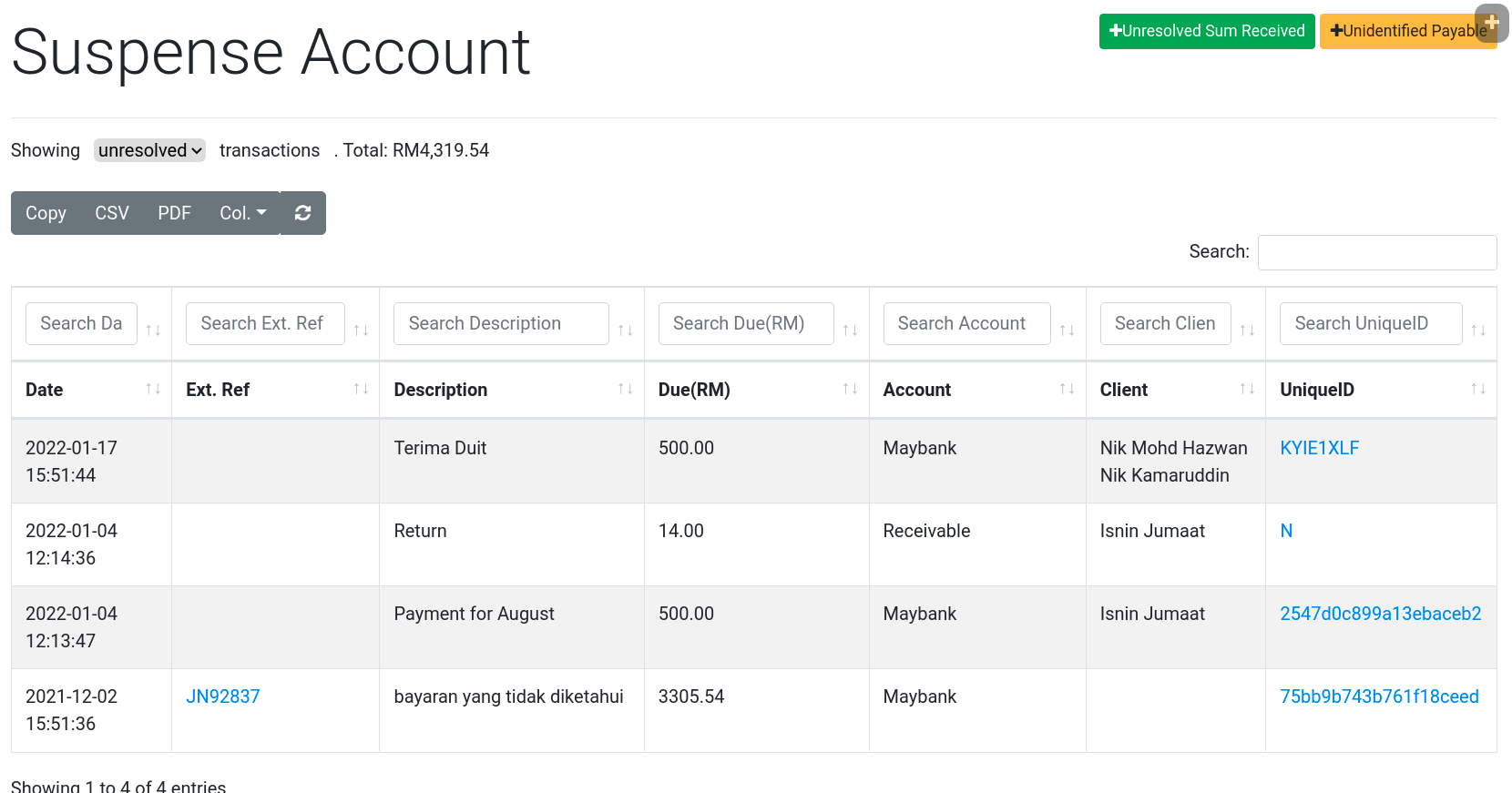

Suspense Account

Any unidentified or partially informed transaction can be recorded onto a suspense account. This is true for both partially informed payable or payment. In the Suspense Account page, user can use the 2 buttons displayed to record such transaction.

Each of these transaction must be cleared when enough information is received about it.

To resolve a suspense account transaction, user can click on either its reference or its uniqueid.

Unresolved Transaction

Unresolved suspense account transaction is displayed here, with several options on how to resolve it. If the transaction come with an external reference, it can be recorded into the Reference input.

On the Debit section, user can add a debit transaction using:

- Direct debit; using the green +Debit button,

- Payables; if the profile involved has any pending payable, it can be added against this transaction using the +Payable button,

- Credit Notes; if the profile involved has any unused Credit Note, it can be added against this transaction using the +CN button.

On the Credit section, user can add a credit transaction using:

- Direct credit; using the yellow +Credit button,

- Invoices; if the profile involved has any pending invoice, it can be added against this transaction using the +Payable button.

Once the debit and credit is balanced, the suspense account transaction is considered resolved. If any of the credit is from an invoice, the title of this document changes into Official Receipt.

Keep Clients & Vendors Informed..

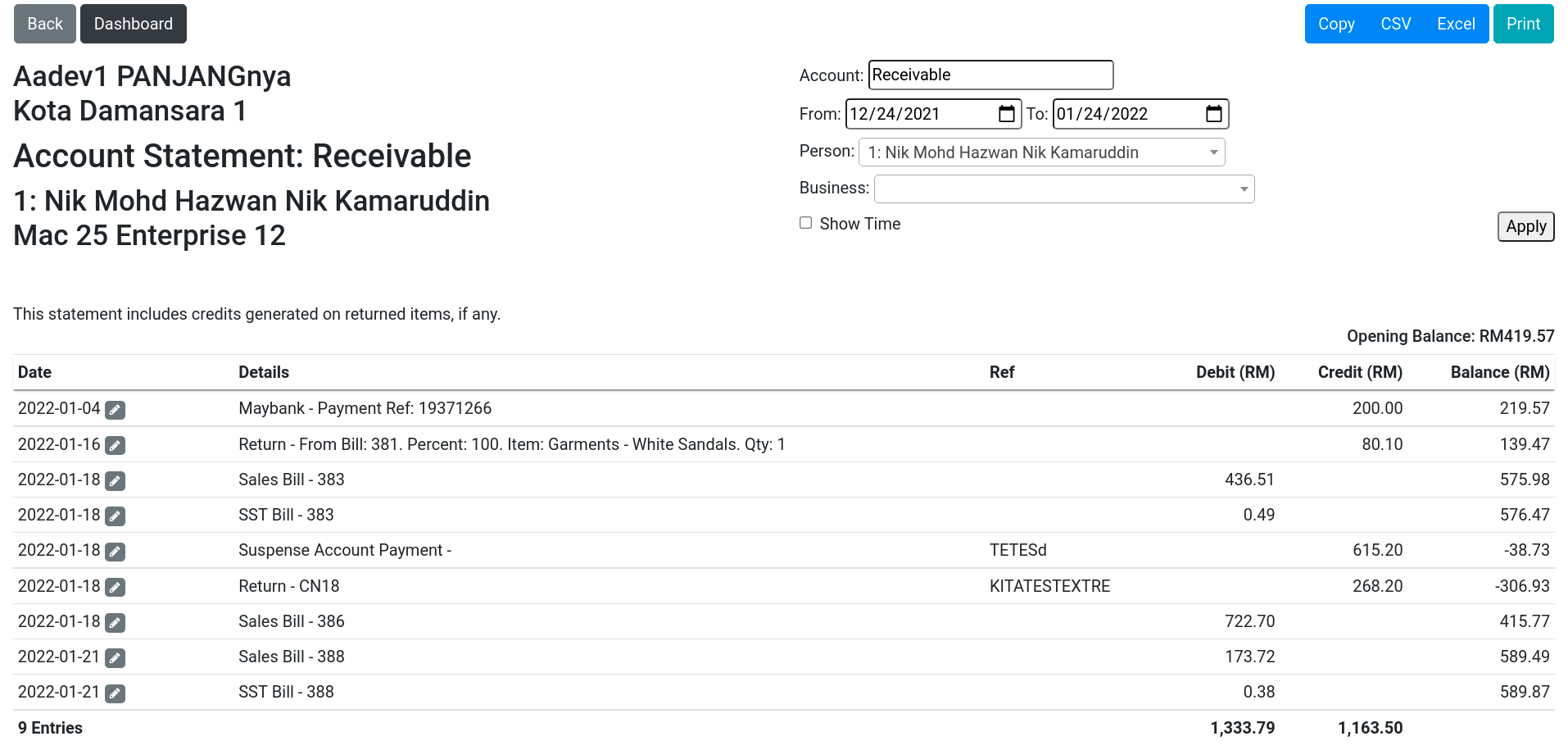

Account Statement

Account statement displays the opening balance, all debit and credit transactions, and closing balance of the selected account.

This can further be filtered by profile or company, to show only transactions involving the selected profile or company.

If the account is the Receivable account, by choosing a profile, it will serve as the client’s account statement with balances, and debt aging at the end of the statment.

If the account is a bank account, a button will appear for reconcilation against the actual statement from the bank. Clicking on the button will enter into reconciliation mode with some additional functions to help with the process.

On top of the Account Statement, user can click on Aging button to see the Aging Statement by profiles, on that particular account.

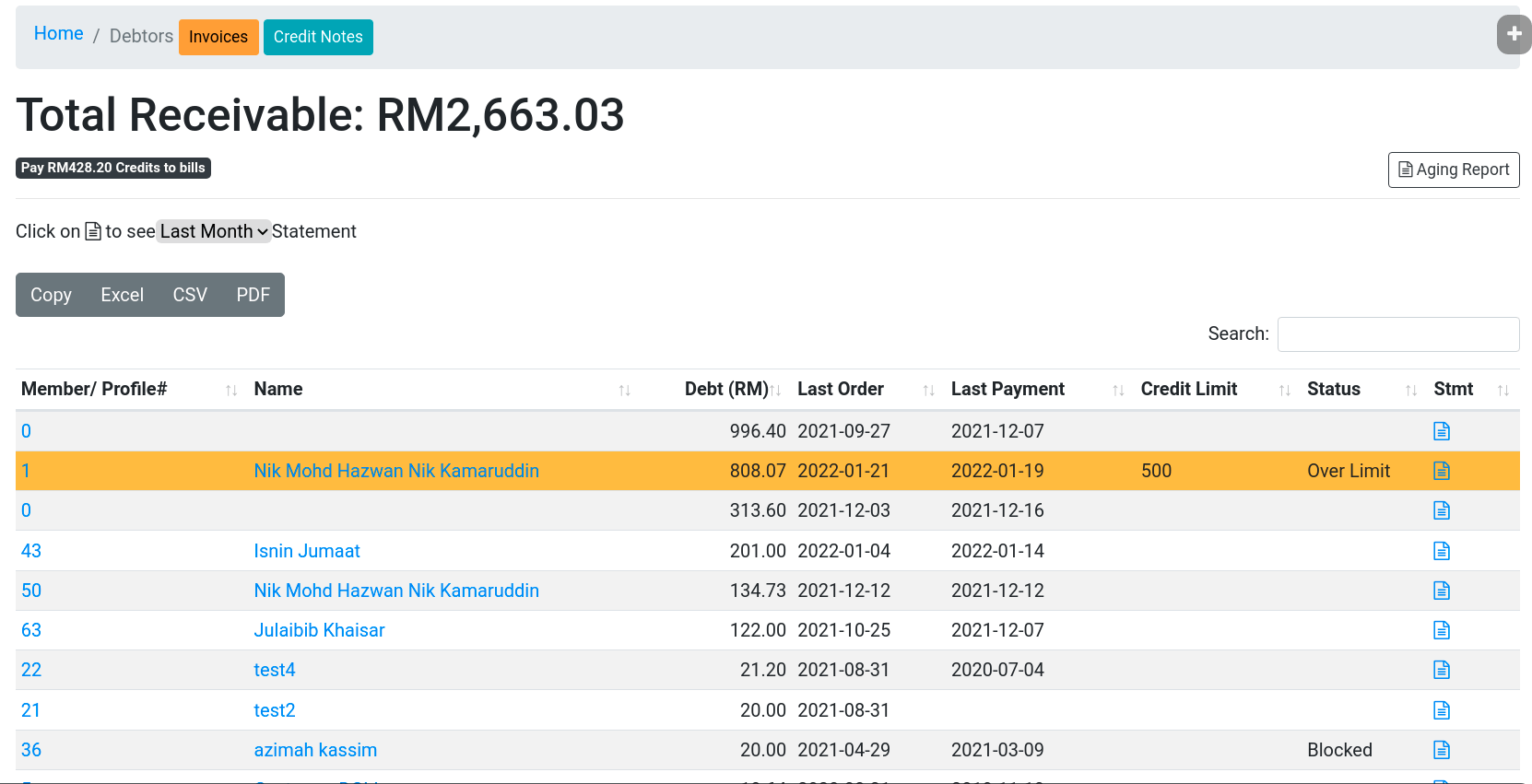

Debtors

List of clients with receivable balance is shown with the debt value, last payment made, credit limit, block status, and statement button.

If a client credit is over its set limit, the row will be yellow coloured. User then take action to block any new order for the client.

To see the account statement for a client, simplt click on the statment button in its row.

On the top right of the page, there is a button labelled Aging Report. User can use this button to access the Debtors Aging Report.

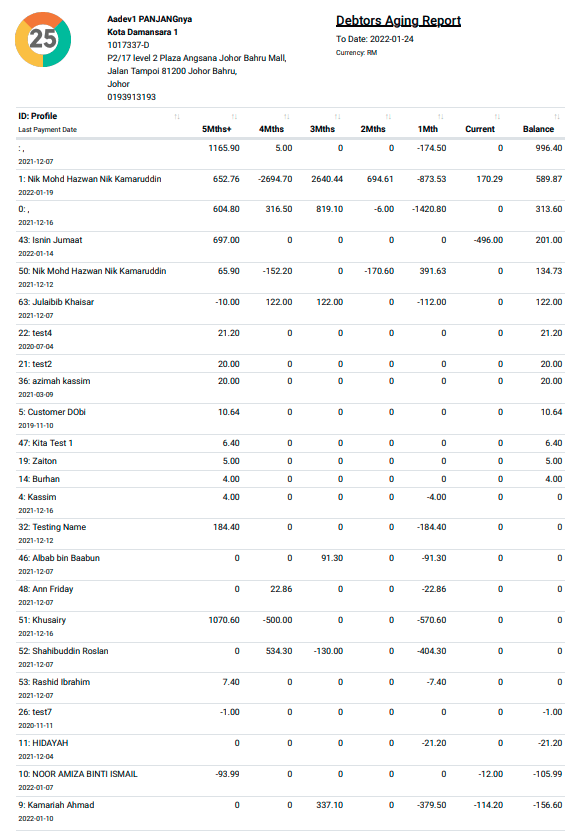

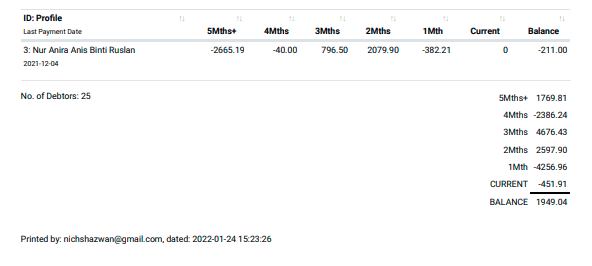

Aging Report / Debtors Aging Report

Summary of profiles transaction value over recent month on a selected account is shown in this Aging Report. This is useful to get insightful recent value of clients or vendors for a particular account. The values are summarized onto: 5 Months and above, 4 Months, down until 1 month, Current, and total Balance.

If the account is receivable, this will serve as the Debtors Aging Report.

At the bottom of the report, all transaction values are summarized onto the same format of months.

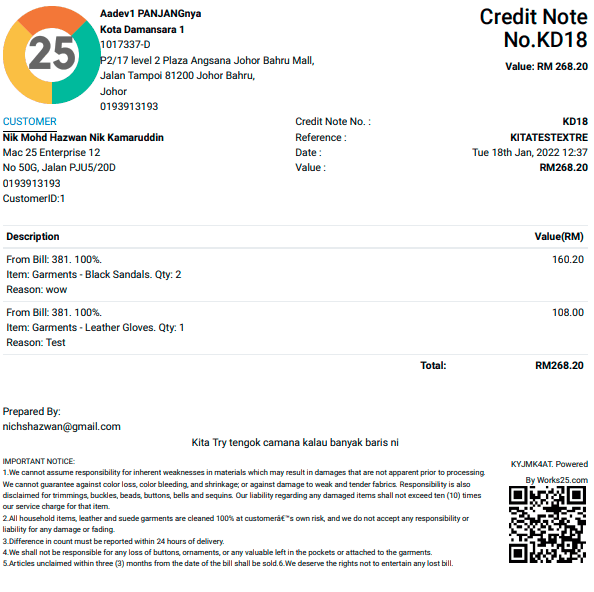

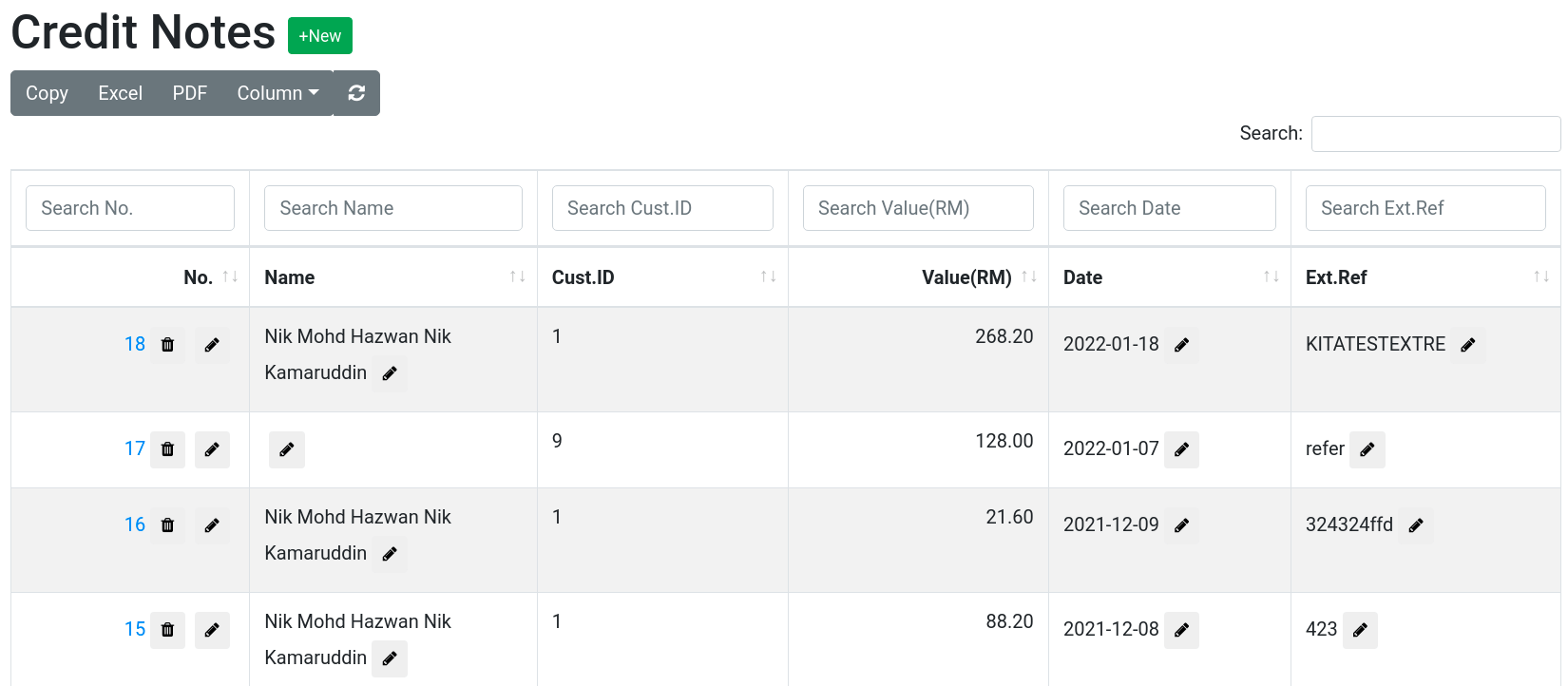

Credit Notes

List of Credit Notes can be accessed via a light blue button in Debtors. Credit Notes are created from returned item by a client. To create one, user can click on the green +New button. Then, user can select from delivered items that are returned by the client.

Credit Notes can be used to resolve a Suspense Account transaction, in which it will be marked as used.

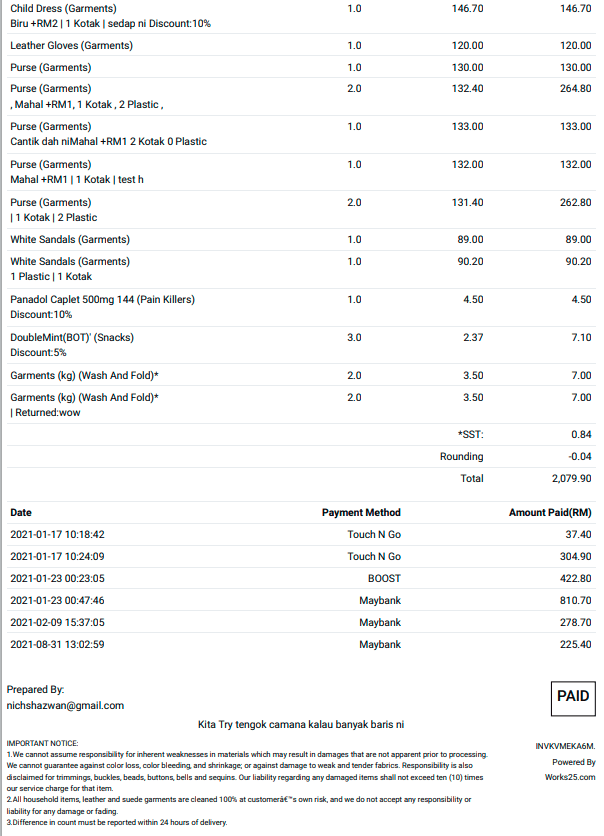

Flexible Operational Bills..

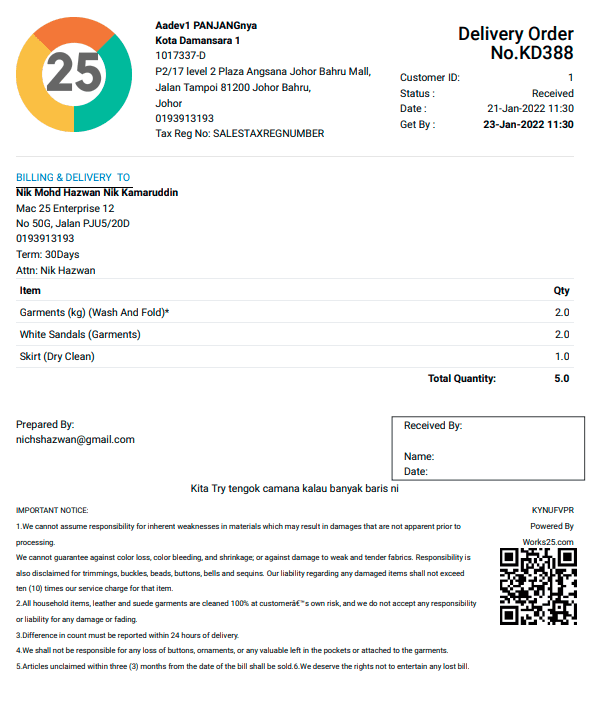

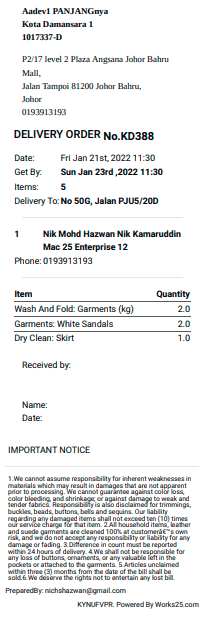

Delivery Order

An order can be printed as invoice or delivery order, if it is yet to be converted permanently into a delivery order.

Several delivered orders can be grouped into an invoice. The invoice will contain all the D.O.s with the item breakdown summary of all the D.O.s.

Hence, there is 2 type of D.O.s; one is a regular order, but printed as a D.O; and the other one is the converted delivered orders into single invoice.

Invoice And Receipt

There are 2 types of invoice;

- A normal unpaid order, which dan be printed as an invoice, or as a D.O.

- A summary of converted D.O.s into one invoice.

Invoices can receive multiple payments as deposits or discounts.

Either invoice will appear as receipt once payment has been made in full.

Purchase Order

Purchase order can be made through inventory module, after counting items-to-order. Upon item arrival confirmation, the purchase order will be converted onto payment voucher with the vendor as its payee.

If any item was previously returned to the vendor and saved as debit note, it can be used againts the payment voucher.

Checker-Maker

This option can be enabled in General Settings. If enabled, each expense or transfer transaction made by a maker will enter into pending transactions list. The checker will then approve the transaction from pending list into the journal.

Both the maker and the checker ids are recorded as person responsible for the transaction.

User Centric Design

The system is designed to be easily maneuverable, with modules layered from basic functions on the surface, and deep into complex analytical queries on a few clicks.

Naturally Easy

With user centric design, the system feels naturally easy to use.

Automated Checks

The system checks and suggests solutions to any data entry error automatically.

Dedicated Help Personnel

Each client will be assigned to a well-trained account manager, as a dedicated help personnel.

All-In-One Business Management Software

Stop hassling through multiple software to run your business. Have it all in one complete system.

Cloud-Based

Access from multiple devices at the same time, without any worry of data loss.

Authority Levels

Customise access and authority level with over 120 switches, for up to 8 user levels.

Future Proof

Built using the latest web technologies and always up to date with technological changes, no need to worry on being absolete.

Regular Updates

Our updates are twice od thrice every month, as we listen closely to our clients’ needs.

Daily Backup

Backup is done daily at 2am, to 2 different country as redundancy, for that peace of mind.

Unlimited Document Upload

No limit to how much document to be uploaded, as the system uses user’s Google Drive for document storage.

Finance Analytics

See changes as it happens, and compare it with other months, years or any choosen period.

On-Screen Guide

Videos and page guides are cumbersome. Use our step-by-step on-screen guide to get started on the system.

To Do List

Yes, it comes with a to do list, with approver, assignor and assignee; and separated by authority.

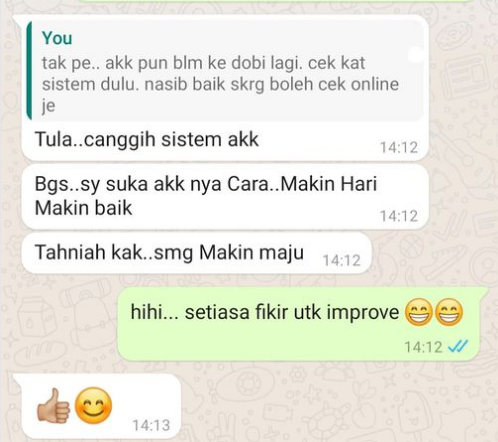

Clients

Pictures, snapshots and testimonials from some of our clients.

recommended best guna sistem ni.. service terbaik.. good for retail and wholesales sistem dh xpening semua ada.. 5 bintang 👍🏻👍🏻👍🏻👍🏻👍🏻

Sistem inilah yang paling baik saya jumpa untuk bisnes dobi saya. Bab pengurusan pesanan, memang nombor 1.

Sistem ini amat memudahkan. Tak perlu lagi saya sentiasa ada di kedai. Kat rumah pon saya boleh monitor bisnes dan production dobi saya.